MBA After CA: What You Need To Know

While many aspire to become chartered accountants, it’s crucial to recognise that this field often confines your knowledge to a specific domain. However, in the era of digitalisation, the job market highly values individuals who can adapt and expand their skill set. This is where the unique benefits of pursuing an MBA after CA come into play, as it can truly transform your career trajectory, offering many options that can propel you beyond the boundaries of your current role.

An MBA can significantly shift and grow your professional life, equipping you with enhanced learning and development skills. This article is designed to provide a comprehensive exploration of the benefits and career prospects of an MBA Program, ensuring you have all the information you need to make an informed decision.

Why Pursue an MBA after CA?

The candidates decide to pursue an MBA program after CA for various reasons. Here are some:

- Broadening Career Options– As a qualified chartered accountant, you already possess fundamental accounting, taxation, and finance knowledge. However, an MBA can provide diverse specialisations in Marketing, Human Resources, Logistics, Operations, and more. The skills you learn during CA and MBA are equally important, but the business market has expanded. An MBA requires a more enhanced skillset for growth and stability in career prospects, offering a wide range of comprehensive career options that can take you beyond the finance sector.

- Networking Opportunities– Pursuing an MBA after CA can open doors to significant networking options that benefit you personally and professionally. An MBA program provides a diverse group of students and executives, fostering a great exchange of valuable ideas. This helps build growth and stability in the organisational sector and expands your professional network, which can be invaluable for future career opportunities.

- Diverse Skillset– An MBA program provides multiple skills to CA professionals to explore opportunities in Strategic Thinking, Business Analytics, Entrepreneurship, Team-Management, Problem-Solving, Leadership, etc. The benefit of an MBA Program is that it enhances your overall ability to attain any business challenges.

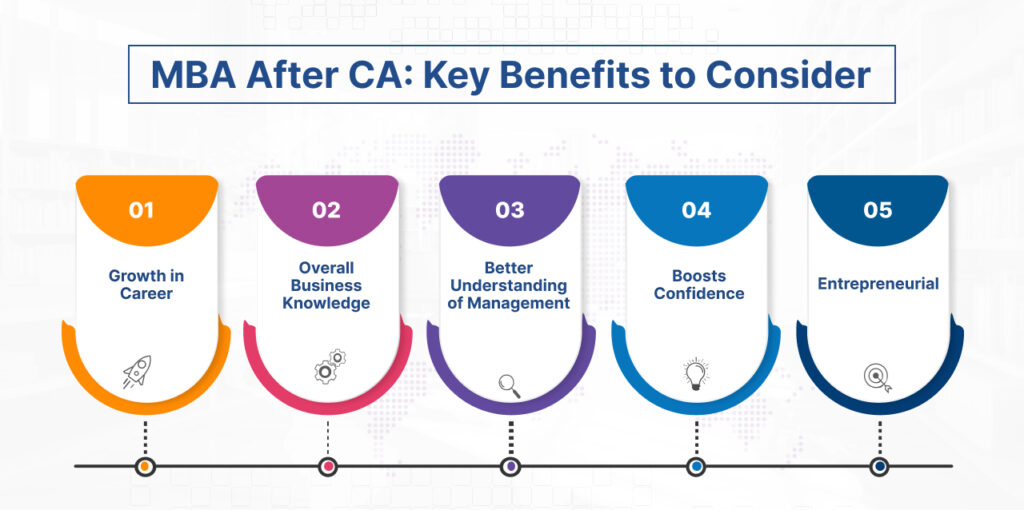

MBA After CA: Key Benefits to Consider

In recent times, no one wants to be restricted to one domain, so they choose an MBA program to inherit new skills, upscale their higher education to match industry-based challenges and learn new business fundamentals.

Here are the reasons why an MBA can be your turning point after earning a CA degree:

- Growth in Career– An MBA program introduces you to several business domains, such as Marketing, Human Resources, Operations, Supply Chain Management, and others. The chances of getting hired become easy if you are an MBA graduate with fundamental skills like leadership, management, problem-solving, critical thinking, and many more to present in the industrial sector.

- Overall Business Knowledge– An MBA degree enhances your business knowledge and widens your strategic, managerial, and leadership skills beyond CA, mainly specified in the finance sector. Business knowledge helps you make insightful decisions and manage all business functions.

- Boosts Confidence– MBA graduates upscale themselves with much-needed confidence to excel in the job market and face the interview without hesitation. The hiring team checks your educational qualifications and emphasises soft skills that reflect how fit you are in diverse roles. The environment where you study hugely impacts your surroundings, which helps you boost your confidence and shapes your career.

- Better Understanding of Management—There’s no doubt that CA can secure you financially, but what if you want to explore different leadership roles in the current business market? Here comes an MBA program that can help you with diverse specialisations and equip you with various learning and knowledge relating to business areas that will significantly lead you to higher management positions.

- Entrepreneurial– The crucial advantage of doing an MBA after CA is that it prepares you with solid leadership and management skills to help you become your own boss. Gone are the days when people prioritised a 9-to-5 job; now, in the evolving digitalised world, everyone wants to build their start-up and witness its success over the years.

Choosing the Right MBA Program After CA

Selecting an MBA program that correctly aligns with your career goals is essential. Here are the points to consider before choosing the MBA program:1.

1. Global Accreditation and High Reputation—When choosing an MBA program, check the global accreditation bodies like The Association of MBAs (AMBA), The International Accreditation Council for Business Education( IACBE), The European Quality Improvement System( EQUIS), and The Association of Advanced Collegiate Schools of Business (AACSB), which ensure high-quality academic standards.

- 2. Multiple Specialisation– Being a CA professional, you already have a jackpot of financial knowledge, and to expand yourself in the field of business, you can choose different specialisations in that MBA program. Here are some:

MBA in General Management

MBA in Consulting

MBA in Project Management

MBA in Marketing

MBA in Human Resources Management

MBA in Information Technology

MBA in Business Analytics

MBA in Healthcare

MBA in Digital Marketing

MBA in Strategic Management

- 3. Flexibility– The MBA program comes in different formats: full-time, part-time, online, and executive. The choice of an MBA program depends on candidates’ availability, family commitment, work-life balance and learning convenience. If you opt for a full-time MBA course, you can learn immensely from university, whereas a part-time or executive MBA provides learning alongside working side by side. The last is an online MBA, which ensures you can learn at your own pace and preference without hindering your studies and other responsibilities.

MBA After CA: Advanced Career Scope

While CA is a renowned program, pursuing an MBA makes it more significant and preferable. Let’s learn the career scope an MBA degree provides:

1. Diverse Career Opportunities

|

Job Role |

Descriptions |

|

Marketing Manager |

|

|

HR Manager |

|

|

Project Manager |

|

|

Business Analyst |

|

|

Business Intelligence Analyst |

|

|

Investment Banker |

|

|

Product Manager |

|

-

- 2. High Salary Boost– According to a Glassdoor source, one crucial benefit of doing an MBA after CA is the potential salary, which ranges from INR 1,20,568 per month. The demand for MBA graduates is projected to be most valuable worldwide, and therefore, they command higher salaries based on job role, skills, and work experience.

- 3. Global Exposure– An MBA can provide a gateway to global career opportunities. Many MBA programs have a strong international focus, offering global immersion experiences, international internships, and exchange programs. This global perspective is particularly beneficial for CAs looking to work in multinational corporations or explore opportunities abroad.

Conclusion

Pursuing an MBA after a CA is a prominent choice made by those who want to upgrade their education and financial status. It comes with numerous job opportunities and specialisations to build a stable career. MBA brings advancement in salary prospects, defining one’s skills to bring impact in the business sector.

If you are planning career growth, Hike Education is here to help you with all the advantages and guidance you need to transform your career.

MBA After CA: FAQs

Q1. Is an MBA necessary after a CA?

Pursuing an MBA after CA entirely depends on the candidates who want to enhance their careers by delving into an MBA program. An MBA offers a broad specialisation that benefits your diverse job options and increases your salary potential.

Q2. Which MBA course is better after CA?

While there are many courses, opting for these options will improve career paths. Here are some:

- MBA in Consulting

- MBA in Marketing

- MBA in Human Resources

- MBA in Product Management

- MBA in Information Technology

Q3. What is the salary after a CA MBA?

The average salary of MBA professionals after doing a CA is generally around INR 20,00,000 to 22,00,000 annually.

Q4. How does an MBA complement a CA qualification?

An MBA provides comprehensive business knowledge, strategic management ability, and leadership skills, which is how it complements a CA-qualified professional. At the same time, CA limits itself to finance and accounting experience, while an MBA focuses on broader fields such as Marketing, HR, Sales, Operations, Consulting, etc.

Q5. Which is the toughest, CA or MBA?

CA is considered more challenging than an MBA because it delves into the subjects of Taxation, Financial Accounting, Business Environment, Auditing, Reporting, etc., which requires detailed knowledge of each course curriculum.

.png)

.png)