Exploring Top BBA Career Options: Your Gateway to Success

In the fast-paced business world, a Bachelor of Business Administration (BBA) degree stands out as a powerful credential that opens doors to many career opportunities. Whether you aim to climb the corporate ladder, start your venture, or specialise in finance, marketing, or human resources, a BBA provides the essential knowledge and skills to thrive. In this blog, we will discuss the best BBA career options, salary, and the best companies to apply to. Let’s explore!

Introduction to BBA Career Options

BBA is a general, flexible undergraduate degree program with essential business knowledge. It is a field that encompasses elements like management, marketing, finances, human resources, and operations. This is true as the BBA embraces a generalised learning process that prepares graduates for any job market.

If your goal is to be employed with an MNC, want to have your own business, or be part of a government organisation, then BBA can be the perfect stepping stone for you. Now, let us explore some promising job profiles that successful candidates in BBA are likely to enter.

Top 8 BBA Career Options

Here is a table summarising the career options, their average salaries in India, and the top companies that hire for these roles:

|

Career Option |

Salary (India) |

Top Companies |

|

Data Scientist |

10 lakhs per annum |

TCS, Infosys, IBM, Accenture |

|

Digital Marketer |

7 lakhs per annum |

Google, Facebook, Amazon, Flipkart |

|

Business Analyst |

8 lakhs per annum |

Deloitte, McKinsey, Accenture, Infosys |

|

Product Manager |

10 lakhs per annum |

Google, Microsoft, Amazon, Apple |

|

HR Manager |

10 lakhs per annum |

Tata Consultancy Services, Accenture, Deloitte, Wipro |

|

Advertising Manager |

12 lakhs per annum |

Ogilvy & Mather, JWT India, McCann Worldgroup, DDB Mudra |

|

Financial Expert |

12 lakhs per annum |

HDFC Bank, ICICI Bank, SBI, Axis Bank |

Note – Average salaries are subject to change based on market conditions and individual qualifications.

1. Data Scientist

In today’s world, data is everywhere. It seems impossible to avoid it, yet it is impossible not to embrace it. The insights derived from such analyses help firms formulate business strategies that enhance the appeal of their offers and satisfy consumers’ needs.

This is where data scientists come into play. Data science is a professional field in which a data scientist collects data and analyses it to make policies, decisions, or strategies.

After getting your BBA degree, you can choose to be a data scientist by learning more about data analysis, with data programming and improving your IT skills in statistics. As the business landscape evolves, BBA career options expand, offering graduates more opportunities to excel.

2. Digital Marketer

The digital marketing industry is evolving very fast. It is a marketing technique that includes selling products and services through technological themes like social media, search engines, and emails.

Marketing is one of the basic areas of a Business Management degree and also a field that offers knowledge regarding marketing strategies, customer psychology, and marketing analysis. This is one of the BBA career options for the future generation.

3. Business Analyst

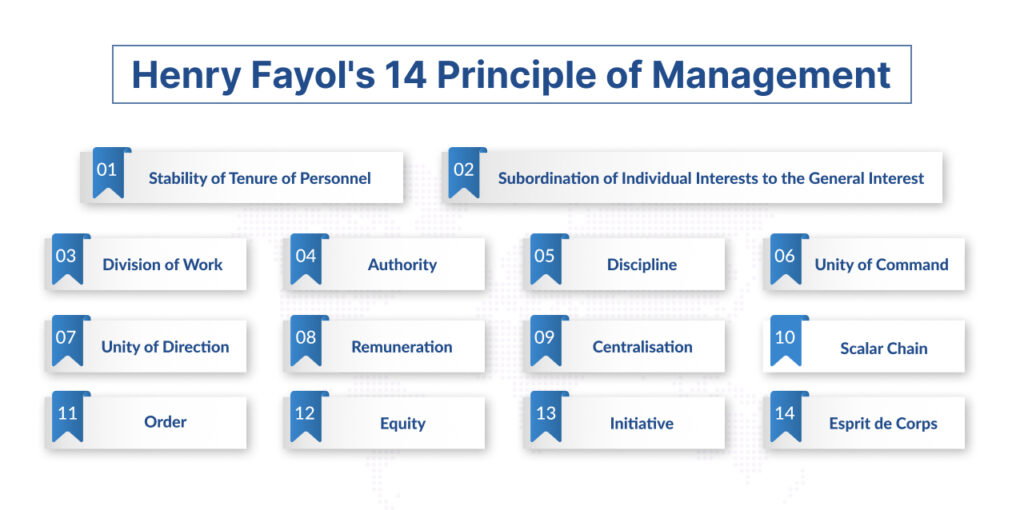

Business analysts are crucial in helping organisations improve their processes, products, and services. They analyse business needs, identify areas for improvement, and recommend solutions to enhance efficiency and profitability.

When you complete your BBA, you’re ready to understand the business environments you intend to serve, mechanical and organic analysis, and business strategy.

To transition into the business analyst position, some extra education in data analysis, project management, and business intelligence may be necessary. This career opportunity is an excellent opportunity to be involved in different processes and contribute to the organisation’s performance. Business Analyst is the best-known BBA career option nowadays.

4. Product Manager

Product managers create products and are held accountable for their success/independence. This team collaborates and engages with other functional teams, such as engineering, marketing, and sales departments, to guarantee that products comply with customers’ needs and business objectives. Product managers can also be the best BBA career options for the future generation.

5. HR Manager

Human resource managers manage human capital, commonly referred to as HR, in carrying out organisational affairs. These include issues of staffing, training employees, maintaining good employee relations, and compensation and benefits.

The larger roles of HR managers comprise making sure that the work environment is congenial and that employees do not experience dissatisfaction.

To obtain this position, one requires knowledge and skills that may be obtained by pursuing a BBA degree with a major in human resources. Further, it is possible to acquire experience by working as an intern or as a holder of an initial position in the field of HR to achieve great performance as a human resources manager.

Human Resources (HR) offers compelling BBA career options, with job profiles such as HR manager and recruitment specialist, focusing on talent management and employee relations

Read More: One-Year Online MBA Program: Eligibility, Fees, and more

6. Advertising Manager

They supervise advertising campaigns for products or services, ensuring customer awareness and demand. They collaborate with creative groups, media planners, and the client to ensure that advertisement campaigns and indexes reach the targeted people.

With a focus on creative and analytical skills, BBA career options like advertising manager and data analyst offer graduates diverse opportunities to thrive in various industries.

Therefore, having a BBA degree emphasising marketing or advertising will enable one to be fit for this position. It’s about consumers’ consumption and utilisation patterns, along with marketing and communication tools.

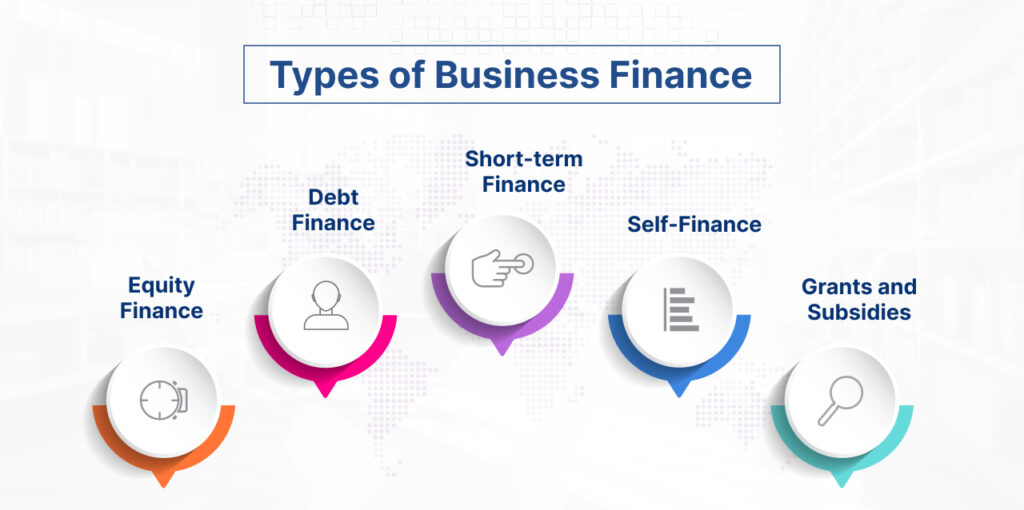

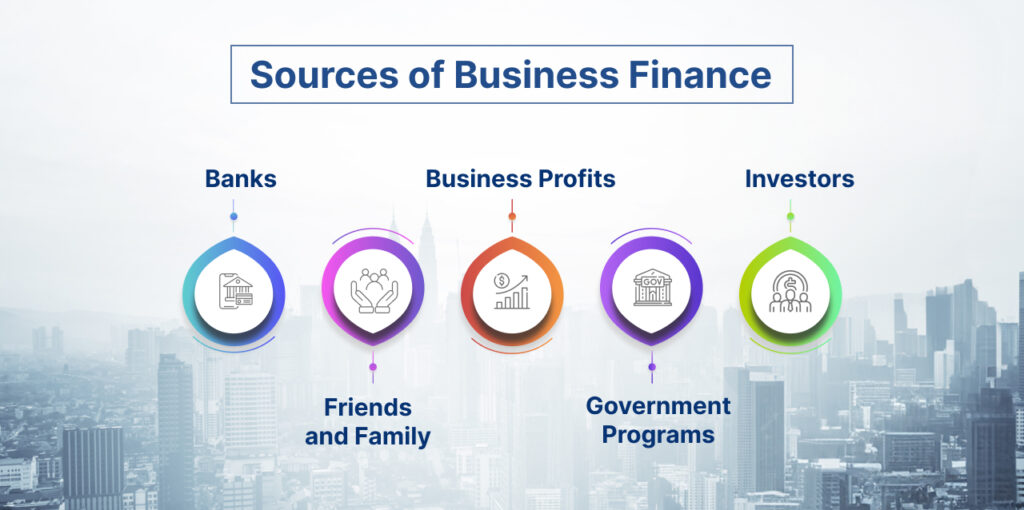

7. Financial Expert

Financial experts or Advisors are people with expertise in finance who assist people and firms in making sound financial decisions. They interpret business data, evaluate the prospects of an investment, and advise on how to acquire funding to fulfil certain objectives.

With this BBA degree focused on finance, you will develop a solid understanding of financial concepts, financial accounting, and investment analysis. You can pursue further academic credentials, such as CFA or CFP programs.

8. International Business Specialist

In a world experiencing higher degrees of globalisation, it is imperative to have international business specialists to help operating companies expand into other countries.

International business roles are prominent among BBA career options, providing job profiles like international trade specialist and global supply chain manager for those interested in global commerce.

They grasp elements of international business, the import/export of goods and services, and cultural variations, which assist organisation in managing business operations in international markets.

To perform this role, an individual must possess specific fundamental skills and knowledge, which can be obtained from a BBA degree and a focus on international business.

You may also add other skills, such as learning new languages to communicate well with independent or developing countries, experience in international business or trade, or knowledge of global economic trends, that may help as well.

Government Jobs After BBA

In addition to the diverse career options in the private sector, BBA graduates can also explore opportunities in the public sector. Government jobs offer stability, competitive salaries, and various benefits. Here are some government job options for BBA graduates.

Sector | Roles | Salary (Annual) |

Banking Sector | Probationary Officer (PO), Clerk | 8 Lakhs |

Civil Services | IAS, IPS, IRS | 10 Lakhs |

Public Sector Undertakings (PSUs) | Management Trainee, Assistant Manager | 8 Lakhs |

Railways | Station Master, Commercial Apprentice | 8 Lakhs |

Defence Services | Officer in the Indian Army, Navy, and Air Force | 15 Lakhs |

State Government Jobs | Municipal Officer, State Public Service Commission roles | 8 Lakhs |

Note: Average salaries are subject to change based on market conditions and individual qualifications.

Civil Services

In India, the civil services examination, conducted by the Union Public Service Commission (UPSC), is one of the most recognised examinations in the country. Any BBA graduate can take this examination and opt for a brilliant Administrative Service like IAS, IPS, or IFS.

These roles are patriotic, and the candidate must be ready to play a vital role in transforming society.

Banking Sector

Candidates with a BBA degree can opt for various posts in Indian public sector banks, such as Probationary Officer (PO), Clerk, and Specialist Officer. These jobs require candidates to undertake tests conducted by the Institute of Banking Personnel Selection (IBPS).

Banking is a good profession because of the numerous employment and training prospects, security, and outstanding benefits.

Public Sector Undertakings (PSUs)

Public Sector Undertakings, otherwise known as PSUs, are government enterprises that offer job openings in different streams for BBA graduates.

The Bachelor of Business Administration (BBA) holder is, therefore, very marketable and may find opportunities in firms such as Bharat Heavy Electricals Limited (BHEL), Oil and Natural Gas Corporation (ONGC), and Steel Authority of India Limited (SAIL).

Combine your passion for public service with your business knowledge acquired from a BBA degree by exploring the diverse career paths in civil services, one of the many rewarding BBA career options.

The versatility of BBA career options is evident in government roles like tax examiner and customs officer, where graduates can play a crucial role in revenue collection and regulation.

State Government Jobs

They also have the option to work in state government departments for employment after they complete their BBA degree. For any administrative, finance or manager post, there are examinations that each of the States sets for their people. These jobs are many, well-paid, rooted in the community and serve many people.

Read More:- What is the entrance exam for MBA?

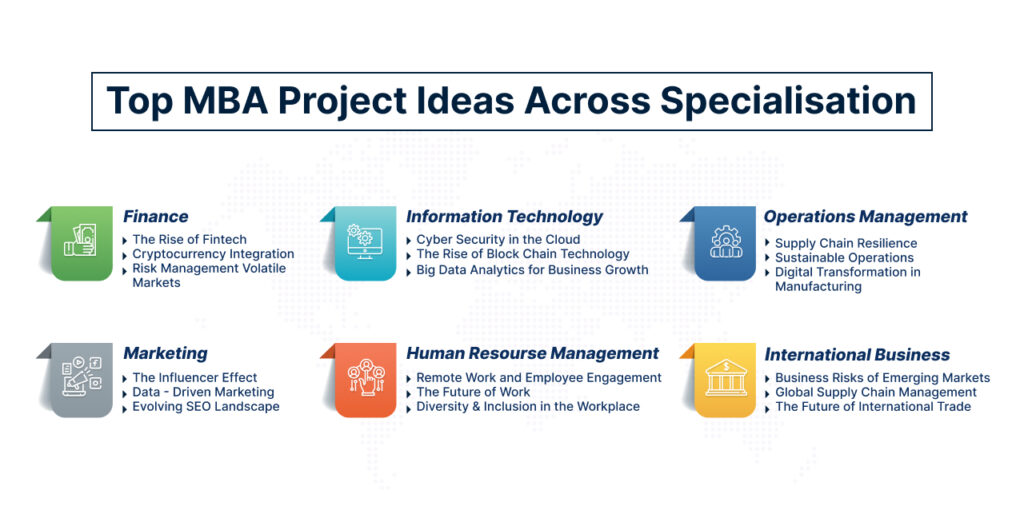

Options for Further Study After BBA

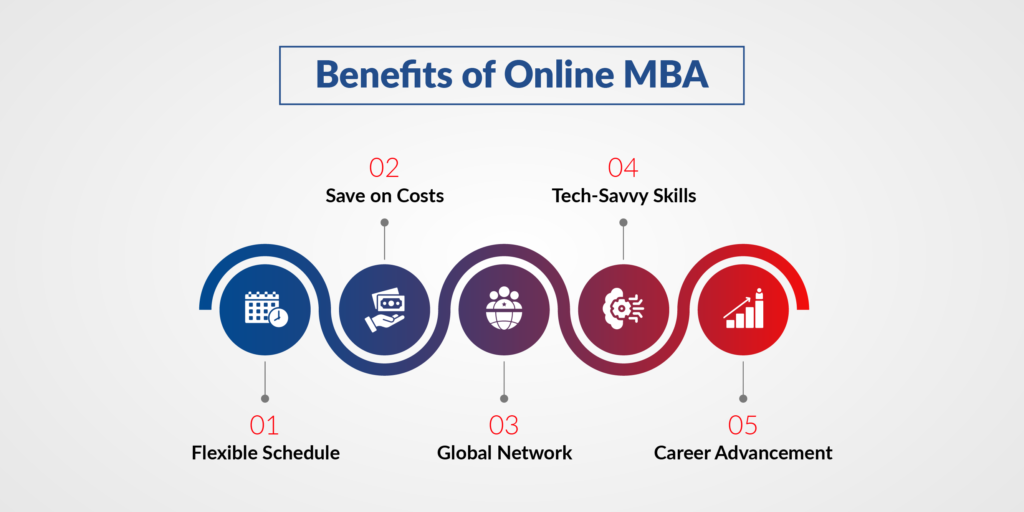

- Master of Business Administration (MBA): Offers advanced knowledge in business administration and management, with specializations available in areas like finance, marketing, entrepreneurship, and international business.

- Master of Science (MSc) in Business Analytics: Focuses on advanced statistical and analytical techniques for interpreting complex data sets, making graduates highly desirable for data-driven decision-making roles.

- Master of Science (MSc) in Marketing: Provides advanced coursework in marketing strategies, digital marketing, market analysis, and consumer psychology, preparing graduates for leadership roles in marketing management and market research.

- Master of Human Resource Management (MHRM): Specializes in talent acquisition, employee relations, compensation management, and organisational development, opening up opportunities for leadership roles in HR departments.

- Chartered Financial Analyst (CFA) Program: Ideal for those interested in finance and investment management, covering topics such as investment analysis, portfolio management, and ethics in finance, leading to careers in investment banking, asset management, or financial consulting.

Note – If you’re feeling uncertain about which path to take for further studies after your BBA, check out Hike Education’s website for personalised career guidance. We’re here to assist you every step of the way!

Conclusion

Acquiring a BBA degree is one way of being assured of getting into a fulfilling and successfully positioned employment field. This shows that the possibilities are incredibly diverse regardless of whether you decide to work for a private company, to do government service, or to further your education.

One of the most appealing aspects of a BBA degree is the diverse BBA career options it offers aspiring business professionals.

Moreover, gear yourself with the time to manage your spare time by engaging in activities that you are interested in developing skills in or finding the career you really want.

The key is to stay curious, keep learning, and seize the opportunities that come your way. With a BBA degree, the sky’s the limit!

BBA Career Options : FAQs

Q1. What are the best BBA career options?

The BBA degree, upon completion, opens up a number of vocational prospects in different sectors of the economy, including managerial positions, marketing, financial services, and human resources. Some of the employment opportunities for graduates are in private organisation or sectors, going into business on their own, or seeking a government position.

Q2. Can I pursue higher studies after BBA?

Many BBA graduates further their education to advanced levels, such as Master of Business Administration (MBA), Chartered Accountancy (CA), or other specialised master’s programs.

Q3. What skills are essential for a successful career after BBA?

It is essential to develop practical communication skills, leadership, problem-solving, analytical thinking, and adaptation abilities to be successful after receiving the BBA degree. It is also possible to gain specialised knowledge in particular fields, including data analysis, online marketing, or projecting financial results.

Q4. Are internships important for BBA graduates?

Internships are a necessity for BBA students because they help them gain hands-on experience and a view of what awaits them in the field by applying the theory learned at school. Internships can also be beneficial in building your resume increasing your chances of getting a job.

Q5. Can I get 1 lakh salary after BBA?

Pay disparities exist in India for individuals who complete a BBA degree. The typical yearly compensation for graduates of business administration programs ranges from INR 1.5 Lakhs to INR 10 Lakhs, contingent on industry, region, experience, and employer standing.

More Information:-

The Ultimate Guide to MBA After 12th: Eligibility, Job Profiles, Exams and Career

MBA Dual Specialization: A Complete Roadmap

.png)

.png)